IoT in Healthcare Use Cases eBook

Download Your Free IoT in Healthcare Use Cases eBook

Read More

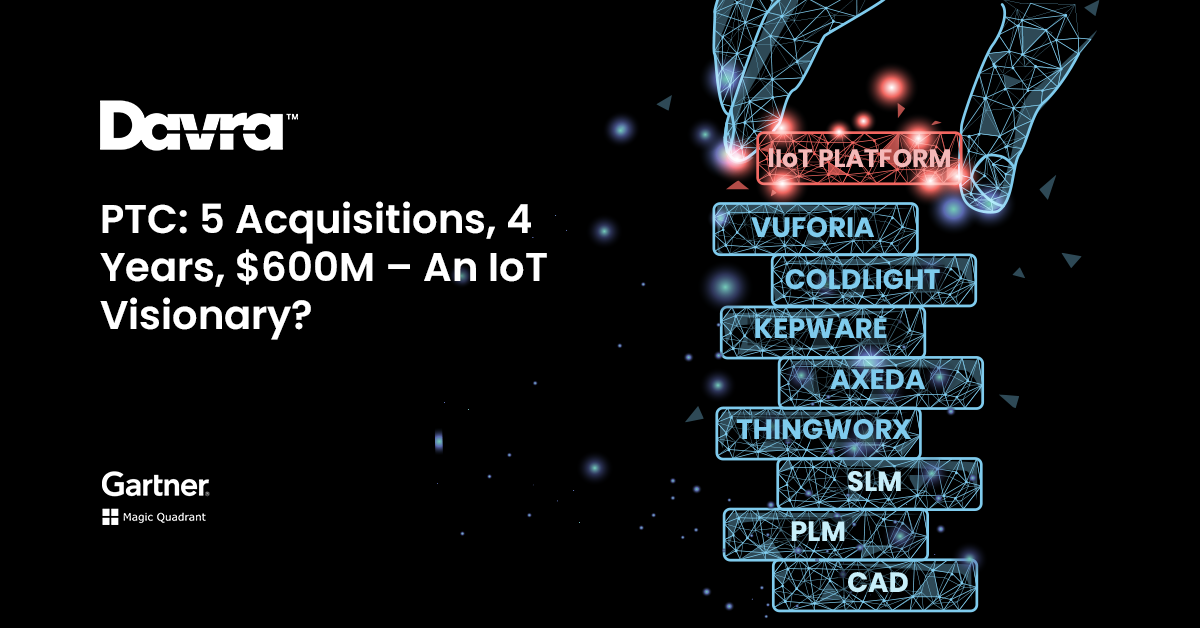

Spanning a history of 30 years, PTC is best known for its CAD (Computer Aided Design) and PLM (Product Lifecycle Management) products.

In 2013 it set out to reinvent itself as an Industrial IoT Company. Fast forward & after 5 acquisitions, PTC is now seen as a visionary in industrial IoT both by industry peers and by market analysts. PTCs formula is to find the best-in-breed components of an IoT Platform, in approximately the $100M range, and integrate them under the PTC brand.

In this blog, we take a high-level look at each of their 5 acquisitions and provide an answer as to the question ‘was it money well spent’.

Acquired: 30th December 2013

Amount Paid: 118M

Main Purpose: IoT Platform (AEP)

Location: Philadelphia, 2009

Venture Capital: 13M

Similar/ Competitors: Davra.com, C3IoT, Software AG.

The first and without question, in my mind, the most important acquisition for PTC as the CAD and PLM company enters into the fledgling IoT Market. Thingworx serves as the original Industrial IoT Platform – sometimes referred to as an AEP.

At the time it was speculated to be an approximate 20X acquisition and announced the beginning of IoT platform acquisition frenzy.

Thingworx, in my opinion, formed the basis of PTC IoT acquisition strategy allowing PTC to understand where the gaps were, where to look down the IoT stack (Kepware, Axeda) and where to look up the IoT Stack (Vuforia, Coldlight).

Acquired: July 24th, 2014

Main Purpose: Device Management

Amount Paid: 170M

Location: Boston, 2000

Venture Capital: 26M

Similar/ Competitors: Telit, Wind River, Davra.com

Axeda is often the forgotten child of the PTC IoT acquisition family but it was the largest of the 5 acquisitions to date. At the time of the acquisition, there were a lot of questions as to the similarities with Thingworx.

Over the years it has become more clear that Axeda’s remote monitoring and management software was utilized to add advanced device management and remote management capabilities to their IoT stack. The brand no longer exists but its technology still forms an important part of PTC IoT offering.

Acquired: May 5th, 2015

Main Purpose: Analytics

Amount Paid: 105M

Location: Greater Philadelphia, 2007

Venture Capital: 11M

Similar/ Competitors: Skytree, H2O.ai, Predixion, Davra.com

Coldlight was a startup that focused on machine learning and predictive analytics. ColdLight’s software aims to tell when a specific component might be nearing failure. ColdLight is thought to serve as the foundation for PTC’s strategy of creating a “digital twin” for every physical thing monitored. In theory a nice acquisition but unsure what makes Coldlight technology unique.

Acquired: Dec 2015

Main Purpose: Edge Data Collection

Amount Paid: 118M

Location: Portland Maine, 1995

Similar/ Competitors: Matrikon, Maverick

Widely seen as an excellent acquisition, Kepware gives PTC a single layer (through OPC) to access over 150 different industrial protocols. Matrikon often seen as the gold standard in OPC Servers is used by many of PTC competitors. As machine manufacturers continue to embed OPC Servers into their machine the importance of Kepware, and its multi-protocol support, will diminish.

Acquired: Nov 3rd 2015

Main Purpose: Augmented Reality

Amount Paid: 65M

Founded: 2008, UK

Similar/ Competitors: Junaio, Wikitude

Vuforia was offloaded by Qualcomm as still seen as a niche business. Qualcomm is focusing on chips to enable VR and AR. I see this as a very astute acquisition at a very good price. Augmented Reality has some excellent use cases today in the Industrial IoT space particularly Manufacturing and Expert Support. There is also a lot of potential to integrate PTC 3D CAD designs into Vuforia AR.

PTC has made some brilliant IoT acquisitions over the years – the Rockwell investment of $1B for 8% of PTC is further evidence of this.

The major aspect I question is how they will integrate these companies and technologies together into a single platform. This will not be an easy task.

A contrasting model to building a leading IoT Platform is what we at Davra.com have done — Hire some of the most talented software architects and engineers on the planet and set out on a single mission to build the best IoT AEP Platform to delight our customers.

Congrats must go to PTC on their IoT strategy on bringing together some nice IoT companies but for a fully integrated purpose-built IoT Platform Davra will continue to lead the way.

Brian McGlynn, Davra, COO

Download Your Free IoT in Healthcare Use Cases eBook

Davra IoT is the only Industrial IoT Platform Available on AWS Marketplace

Read MoreThe Collaboration of Humans & Robots Has Created The Cobot

Read More